Okay, let’s talk about the Indian stock market . HSBC just dropped a note saying they’re still “overweight” on India, meaning they think it’s a good bet. But — and this is a big “but” — they’ve also downgraded earnings per share (EPS) expectations. Confusing, right? It’s like saying, “I love this restaurant, but the food isn’t as good as it used to be.” So, what gives? Should you be loading up on Indian stocks, or is it time to be cautious? That’s what we’re going to unpack.

Why HSBC Still Loves the Indian Stock Market (Despite the Downgrades)

First, let’s understand the “overweight” call. India is a growth story, plain and simple. We have a massive population, a burgeoning middle class, and a government pushing reforms (sometimes smoothly, sometimes not so much). This translates to companies with huge potential for growth. HSBC likely sees these long-term trends as too powerful to ignore, even with some short-term hiccups.

But what about those EPS downgrades? Here’s the thing: earnings downgrades aren’t necessarily a death sentence. They can be a reflection of several factors like global economic slowdown, rising input costs, or just temporary sector-specific challenges. The EPS revisions could signal a need for tempered expectations in the short term, but the overall positive trajectory may remain intact. What fascinates me is that this type of analysis provides an objective overview of what we can expect from the Indian stock market, not just what is immediately apparent.

Think of it like this: imagine a marathon runner who stumbles at the 20-mile mark. They’re still in the race, and they still have the potential to finish strong, but they might need to adjust their pace or strategy. HSBC seems to be saying that India is still a marathon runner worth betting on.

Deciphering the Downgrade | What’s Really Going On?

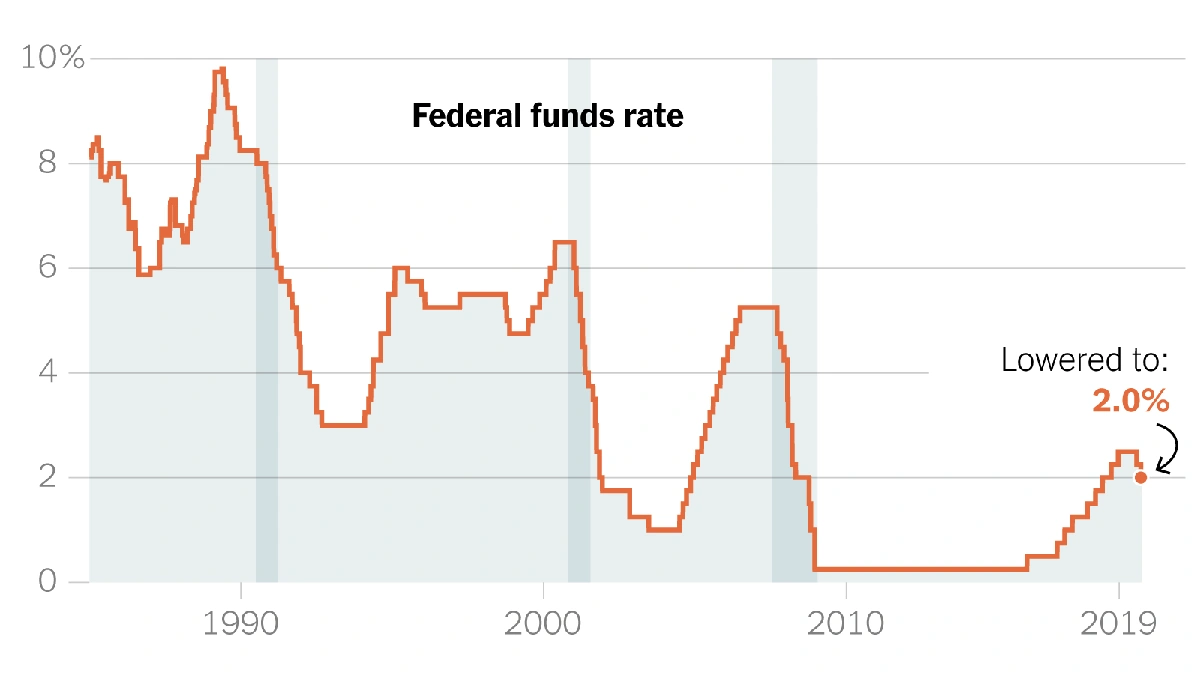

Okay, time to dig deeper. Why the EPS downgrades? Several things could be at play. Global economic uncertainty is a big one. When the world economy sputters, it affects everyone, including India. Export-oriented companies might see lower demand, and businesses reliant on global supply chains could face disruptions. As per reports by the Reserve Bank of India , inflationary pressures and higher interest rates also add to the complexities.

Rising input costs – things like raw materials, energy, and labor – can also eat into company profits. Indian companies aren’t immune to these pressures. And, let’s be honest, some sectors might just be facing temporary headwinds. For example, the IT sector, which has been a star performer, might be seeing slower growth as global tech spending cools off.

Now, the important thing is to see if these downgrades are broad-based or concentrated in specific sectors. If it’s the latter, it might be less of a cause for concern. Investors would need to carefully analyze the companies they have invested in and diversify across multiple sectors to reduce risks. Diversification is the key here.

Navigating the Indian Stock Market | A Practical Guide

So, you’re an investor in India – or thinking about becoming one. What do you do with this information? Here’s the “how” angle – a bit of practical guidance.

First, don’t panic. News like this can trigger knee-jerk reactions, but that’s rarely a good idea. Take a deep breath and assess your portfolio. Are you heavily invested in sectors that are likely to be most affected by these downgrades? If so, it might be time to rebalance.

Second, do your research. Don’t just rely on headlines or what your broker tells you. Dig into the financials of the companies you’re invested in. Understand their growth prospects, their competitive advantages, and their vulnerability to economic headwinds. A common mistake I see people make is not digging deep enough. They see the surface and do not check the details.

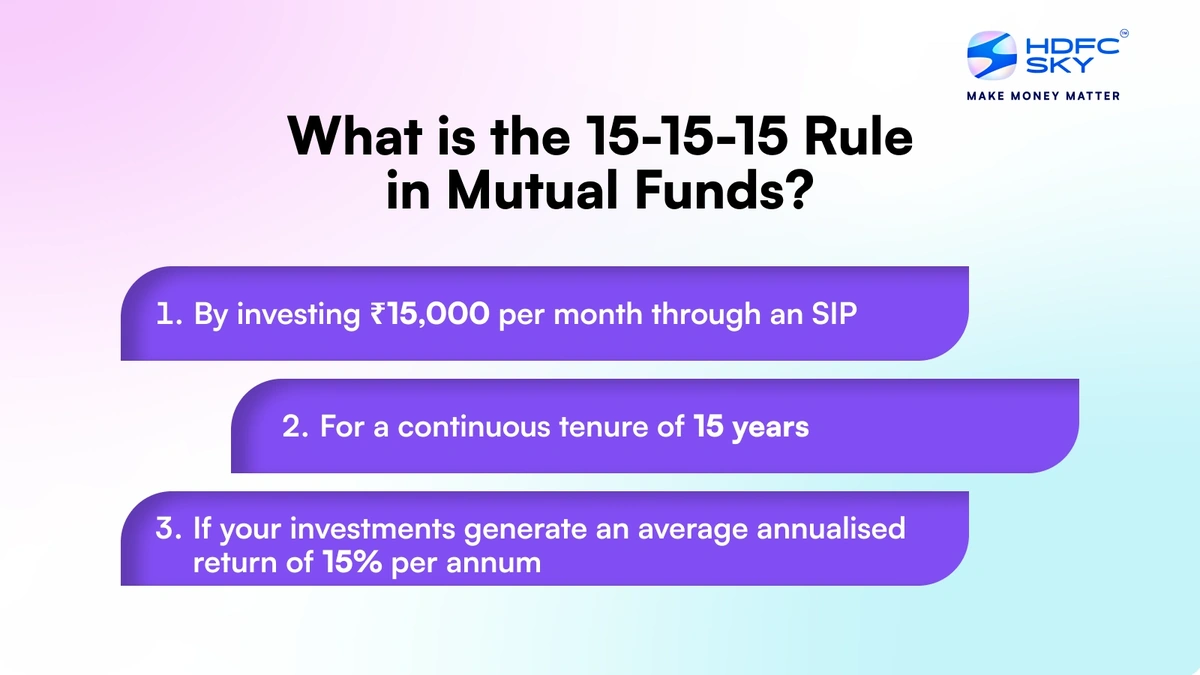

Third, consider a more diversified approach. Investing in index funds or exchange-traded funds (ETFs) can give you exposure to a broad range of Indian companies, reducing your risk. And, let’s be honest, it’s a lot less work than trying to pick individual winners. Here are some top index funds in India for you to choose from.

The Emotional Rollercoaster | Investing in an Uncertain Market

Investing is never purely rational. There’s always an emotional element involved. News like this can trigger anxiety, fear, and even regret. You start second-guessing your decisions, wondering if you should have seen this coming.

The key is to stay calm and focused on your long-term goals. Remember why you invested in the Indian stock market in the first place. Were you betting on India’s growth potential? Did you believe in the long-term story? If so, don’t let short-term noise derail you.

It’s also important to manage your expectations. Markets go up and down. There will be good days and bad days. The goal is to stay invested, stay diversified, and stay disciplined. Let me rephrase that for clarity: don’t try to time the market. It’s a fool’s errand. Focus on building a solid portfolio and sticking to your investment plan. You should keep track of any Indian Stock Market news for the most accurate updates.

The Bottom Line | India Still Has a Lot to Offer

So, where does this leave us? HSBC’s call is a nuanced one. They’re still bullish on India, but they’re also acknowledging that there are challenges ahead. It’s a reminder that investing is not a straight line to riches. It’s a journey with ups and downs, twists and turns. Adaptability is key for any investor.

But here’s the thing: India still has a lot to offer. The long-term growth story remains intact. The potential is still there. The key is to approach the market with caution, do your research, and stay disciplined. Don’t let fear or greed drive your decisions. And remember, even the best analysts can be wrong. The stock market performance is never certain, so you should not invest what you cannot afford to lose.

FAQ Section

What does “overweight” mean in stock market terms?

In investment lingo, “overweight” suggests that analysts recommend allocating a higher proportion of your portfolio to a specific asset (like Indian stocks) compared to its representation in a benchmark index.

Should I sell my Indian stocks because of the EPS downgrades?

Not necessarily. Consider the overall context. If the downgrades are isolated to specific sectors and your portfolio is well-diversified, a knee-jerk reaction might not be the best course. Review your investments, consider your risk tolerance, and make informed decisions.

How can I diversify my Indian stock portfolio?

You can diversify by investing in different sectors (IT, finance, healthcare, etc.), different company sizes (large-cap, mid-cap, small-cap), and different investment styles (growth, value). Investing in mutual funds and ETFs can also provide instant diversification.

What if I’m new to investing in the Indian stock market?

Start with the basics. Learn about different investment options, understand your risk tolerance, and consider seeking advice from a qualified financial advisor. Begin with smaller investments and gradually increase your exposure as you gain experience.

Where can I find reliable information about Indian companies?

Official company websites, financial news portals like Moneycontrol and The Economic Times, and research reports from reputable brokerage firms are good sources of information. Be sure to cross-reference information from multiple sources.

Ultimately, investing in the Indian stock market requires a thoughtful approach, considering both the opportunities and the risks. Don’t just follow the herd, be informed, be patient, and stay focused on your long-term goals. Now, go forth and invest wisely!